TDS stands for Tax deducted at source. One can calculate the TDS using the TDS software which is available in the markets in India. In India, the Finance Minister places the budget before the Parliament in March of every year which fixes the rates for Taxes and other finances which is revenue for the Government to meet the administrative expenses.

The slabs for applicability of taxes for different classes of persons/ associations are clearly detailed in the Finance Bill. The concept of TDS lies on the premise that the tax be paid at the source itself instead by the person/ company receiving the income. The service provider or the taxpaying authority such as corporate or bank before paying monies to the individual deducts tax and then passes on the net amount to the individual/ company as per the tax slabs applicable to the receiver. The tax so deducted is paid to the Government treasury within the time prescribed under the Income Tax Act, 1961.

The net amount in the hands of the receiver is the gross amount receivable less the Tax deducted at source. The source of income thus is liable to deposit the money so deducted into the account of the Government. If the person so deducting tax but does not pay to the government is liable for prosecution and fine as may be decided by the scrutinizing officers in accordance with the applicable laws.

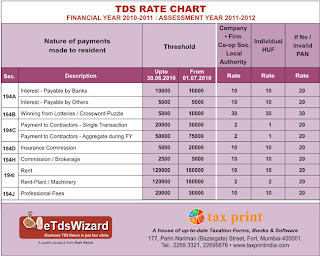

The TDS is deductible in almost every case where the gross amount of outflow is more than Rs 10,000/-. The slabs for TDS are mentioned as a percentage of the gross amount payable and not as whole numbers. For example, a person who has a deposit of Rs 2,00,000/- in a bank receives an interest of Rs 18000/- per annum @ 9% interest on Fixed deposit. At maturity, the Bank should deduct a 10% from this Rs 18,000/- and pay Rs 17200/- (Rs 18000-Rs1800) to the depositor. Similarly, an employee receiving an annual salary of Rs 3 Lakhs or more falls in the taxpaying brackets. Hence, the employer should deduct tax at source and pay the net amount to the employee. At the end, if there is any excess taxes paid or payable is adjusted and accordingly returns are to be filed. In case of salary income, the gross salary is reduced by Provident fund, Mediclaim policies, House rent Allowance, conveyance allowance, Repayment of House Loan, savings under chapter VIA of the Income Tax Act, 1961 and so on. After such reduction, if the salary payable is above Rs 3.00 Lakhs per annum, taxes are deducted at source and net amount is paid to the employee.

In the globalised era, people have moved on from physical filing of taxes to e-filing of taxes. To synchronise the filing of tax returns with the TDS data, the TDS software are being made available to the public at large. This is enabling a green channel for dissemination of data on TDS and tax returns filed by the tax payers in India.